Murray Irrigation

Business Review

The Challenge

Resetting our future: Responding to our generational business review

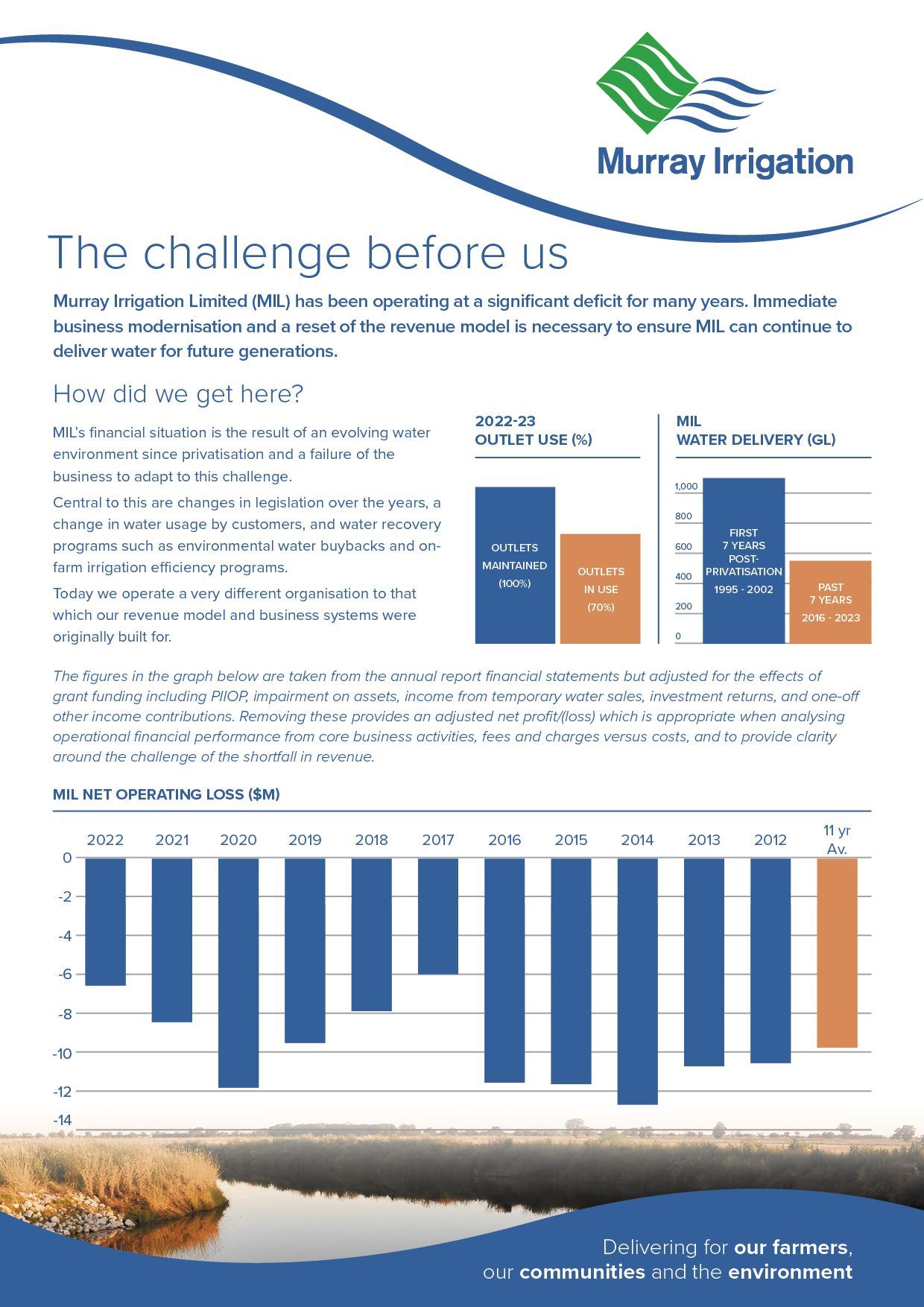

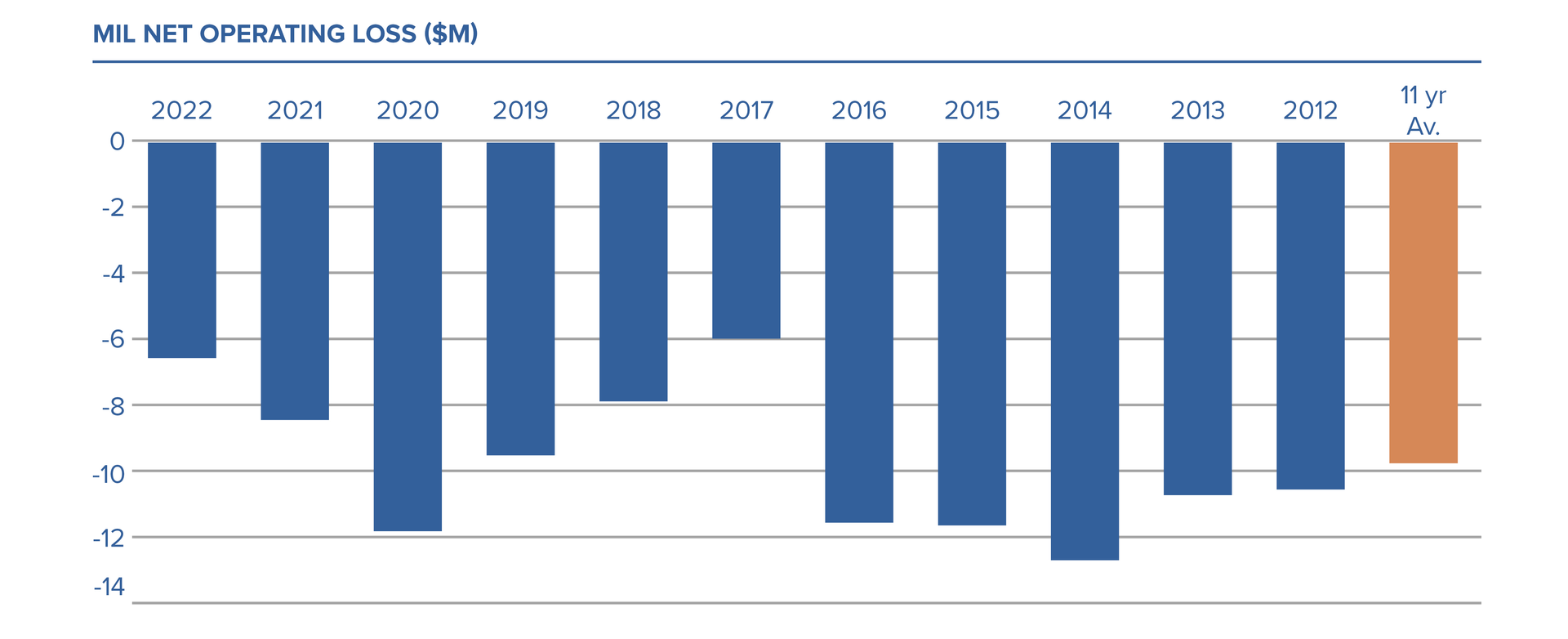

Murray Irrigation has been operating with an ongoing financial deficit for many years. It is the result of a changing water environment, and a failure of the business to adapt to this challenge. Since privatisation, the water delivery environment in our footprint has changed and water delivered by Murray Irrigation to our customers has almost halved. No measures have been put in place for the company to correctly or substantially adapt to these changes, to secure water delivery for our customers into the future.

In September 2022, Murray Irrigation undertook a bottom-up business review of the company’s revenue and costs to address the annual operating deficit, achieve financial security and secure water delivery into the future.

The review has found that the company needs to generate more revenue to build our capital reserves and invest in ongoing modernisation to our infrastructure and IT systems. Substantial investment is required to lower the risk of equipment failure, enhance the security of water delivery, and keep fees as low as possible into the future.

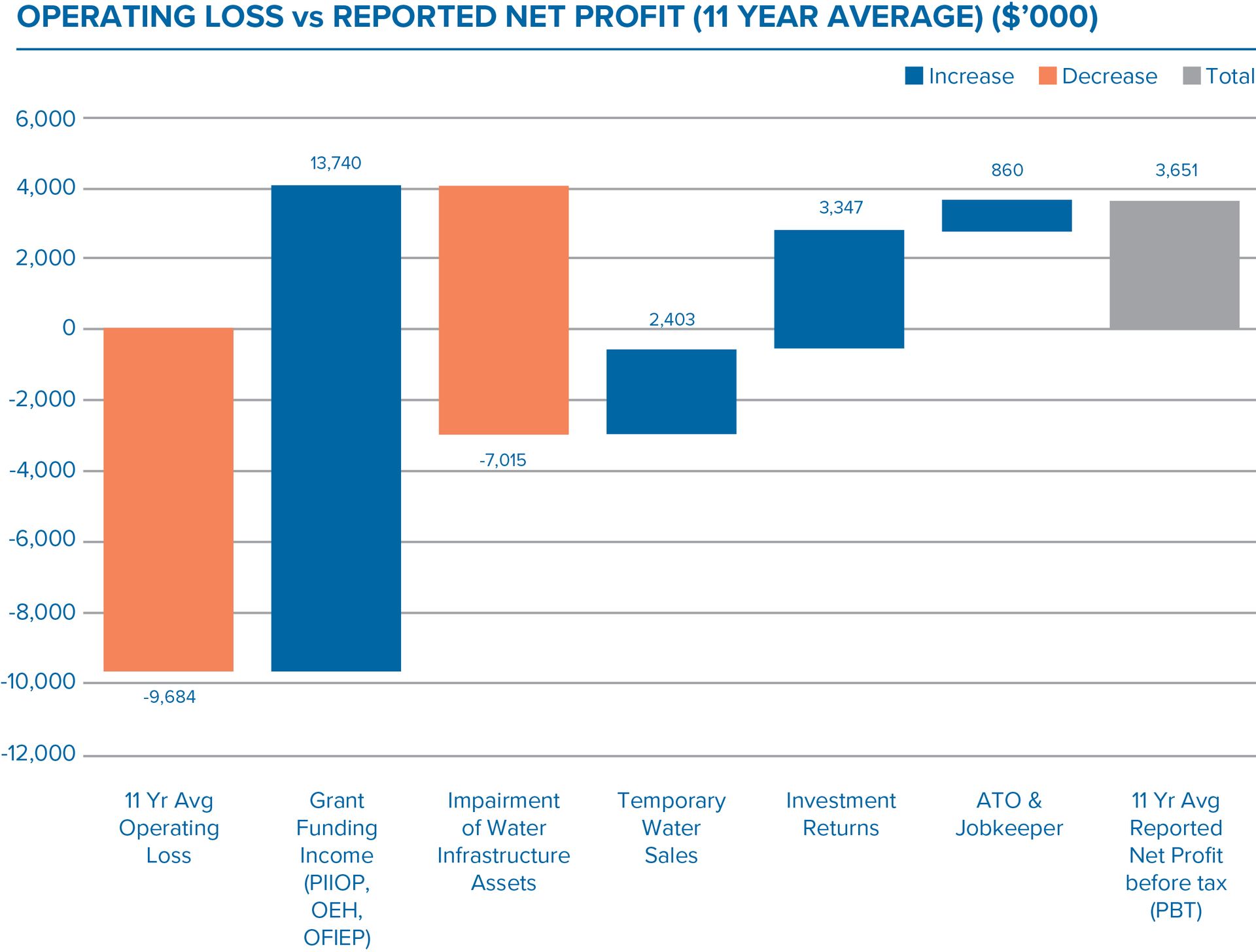

Operating loss - the numbers explained

The figures in the Operating Loss Vs Reported Net Profit (11 Year Average) graph below are taken from Murray Irrigation’s annual report financial statements but adjusted for the effects of impairment on assets (-$7m), income from temporary water sales ($2.4m), investment returns ($3.35m), grant funding including PIIOP, OEH and OFIEP ($13.7m), and one-off other income contributions ($860k). Removing these additional income streams provides an adjusted net profit/(loss) which is appropriate when analysing operational financial performance from core business activities, fees and charges versus costs, and to provide clarity around the challenge of the shortfall in revenue.

Why has MIL not grown its investment fund?

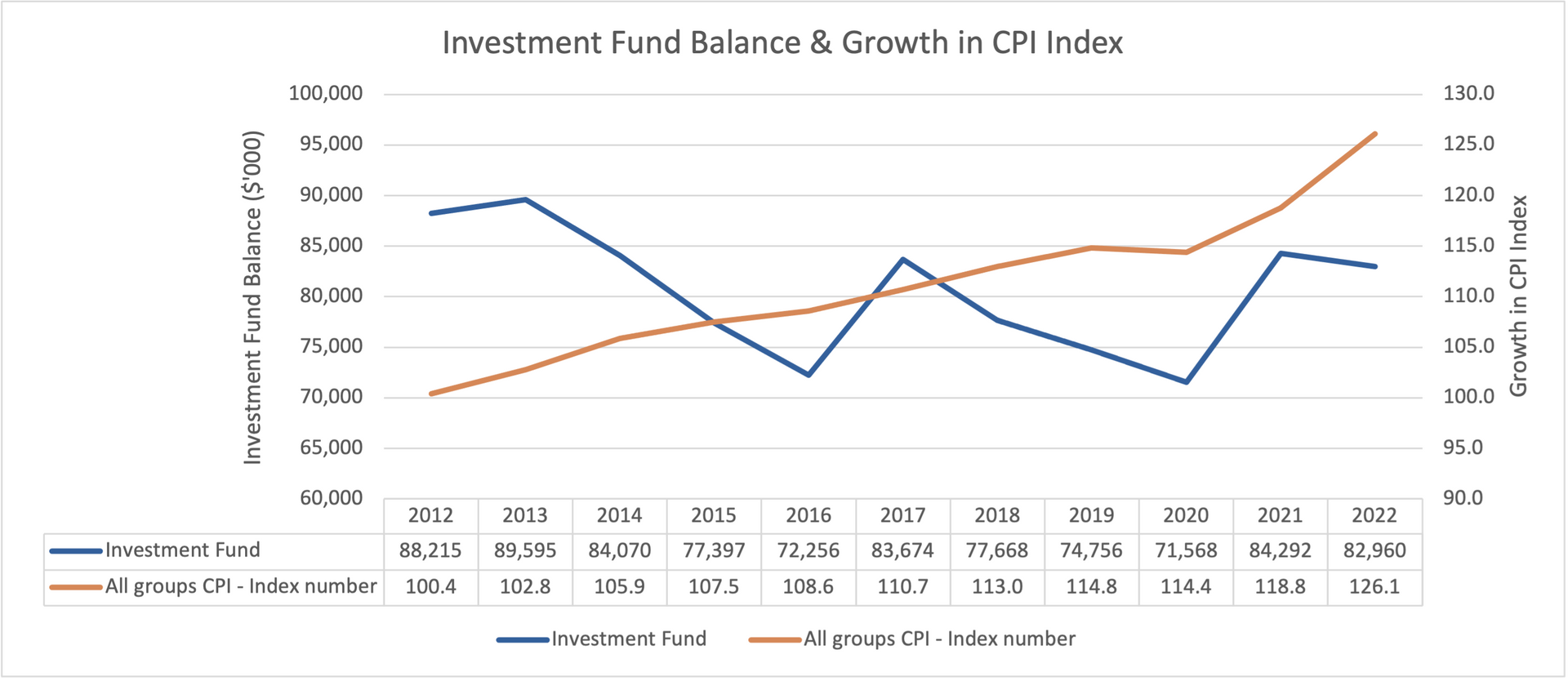

MIL’s investment fund has been in decline over the past 11 years. The fund balance has declined by $5.3m (-6%) in nominal terms since 2012. Non-operational income streams and investment returns have been used to fund capital and operational expenditure. The company has generated insufficient revenue to grow the investment fund. Based on assets and the size of our footprint, MIL needs a fund of around $400m to adequately support future investment in the infrastructure, expertise and technology that services our customers now and for generations to come.

The graph below shows the investment fund balance over the last 11-years and includes the CPI index number to demonstrate that not only has the fund balance been in decline in nominal value but has also declined in real value (after inflation) with the CPI index increasing by 25.6% over the last 11 years. If no action is taken, MIL cannot adapt to the changing water environment, reduce costs, lower the risk of equipment failure, and enhance the security of water delivery for customers, while keeping fees as low as possible. Ongoing investment in the modernisation of our infrastructure and IT systems is required to continue to meet the needs of our customers, staff, and the community in the future.

The Solution

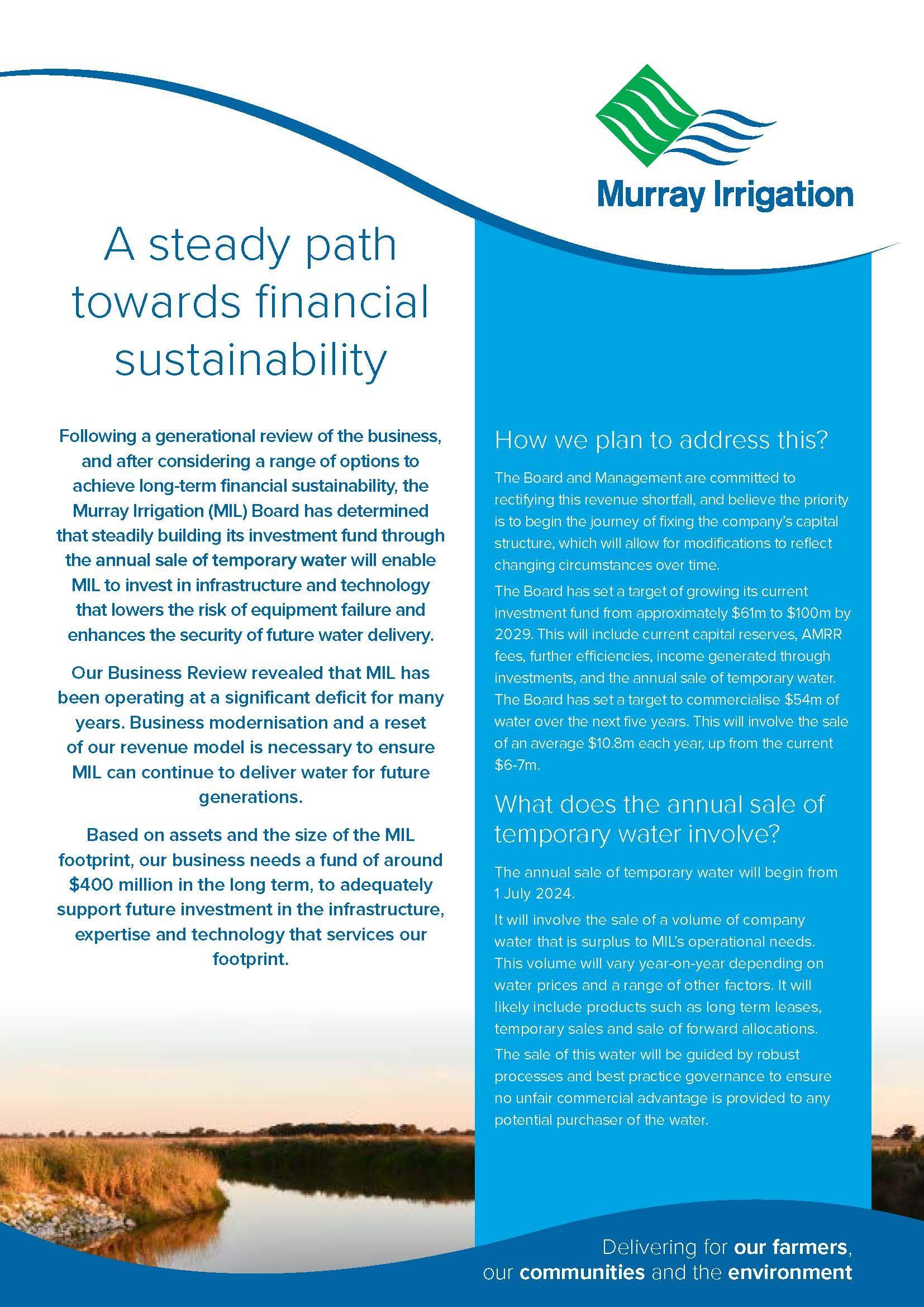

OVER the next five years, Murray Irrigation will seek to grow its investment fund from around $61 million to $100m to set itself on the path to financial sustainability.

Built on current capital reserves, the fund will grow through the annual sale of company water, Asset Maintenance and Renewal Reserve (AMRR) fees, further efficiencies, and income generated through investments. The contribution from the sale of company water will be around $54m over the five-year period, or an average of $10.8m annually. Currently, the business generates an average $6-7m from annual temporary water sales.

This plan is the first step in the establishment of a fund that will provide a foundation from which the business can lower the risk of equipment failure, enhance the security of future water delivery and keep fees as low as possible for future generations.

Customer Information Sessions

On 13 and 14 September, Murray Irrigation hosted three Customer Information Sessions at Deniliquin, Finley and Wakool to provide customers the opportunity to hear directly from Murray Irrigation about the company's generational business review, our findings, and the Board's subsequent decision to complete annual sales of temporary water as the solution to securing the long-term future of water delivery in our footprint.

A video of the presentation, as well as a downloadable PDF of the presentation is available below.

A number of questions were asked throughout the three sessions. Answers to these questions can be found below.

We thank everyone who participated in the Customer Information Sessions. If you have further questions relating to the business review and/or the Board's chosen strategy for long-term financial stability, please feel free to call the team on 1300 138 265 or email review@murrayirrigation.com.au.

Customer Information Session - Questions and Answers

Business Review Process

Investment Fund

WaterWell

Delivery Entitlements (DEs)

Operations and ICT

Fees and charges

Frequently Asked Questions

The Situation

The Review

The Solution

Contact Us

If you have any questions or would like to provide feedback, please email

review@murrayirrigation.com.au and a member of our team will be in touch.